Fallene Ltd What Is Happening With Distribution Of Makeup?

[263 Pages Study] Cosmetic products are manufactured by using chemicals, minerals, and some natural ingredients. Technological advancement in the manufacturing of cosmetic products is one of the driving factors for the cosmetic products market. The economic evolution in the emerging countries has further increased the utilization of cosmetic products, as consumers accept more dispensable income.

Corrective products are segmented into peel intendance products, hair care products, color cosmetics, fragrances, etc. These products are used to raise the dazzler of the consumers by rejuvenating skin, giving shine to the pilus, so on. Distribution channels such as supermarkets, section stores, etc., offering a wide assortment of corrective products and provide a convenient medium for selection of the desired product.

The cosmetics products market is segmented on the ground of types, distribution channels, and geography in terms of value ($Billion). The market segments, by type, include pare care, hair intendance, color cosmetics, fragrance & deodorants, personal hygiene, oral hygiene, lather, bath & shower, sun intendance, and others.

The distribution channels of cosmetic product include supermarkets, pharmacy & drug stores, section stores, straight selling, specialty stores, internet retailing, beauty salons, and others. The geographic segmentation includes market value and volume for the key countries in Northward America, Europe, Asia-Pacific, and Residual of the World (ROW).

This written report provides a full analysis of key companies and the competitive analysis of developments recorded in the manufacture in the past v years. Market place drivers, restraints, opportunities, and burning bug of the market are discussed in detail. The leading players in the market such as L�Oreal Group (France), Alticor, Inc. (U.S.), and Avon Products, Inc. (U.S.) have been profiled in this study.

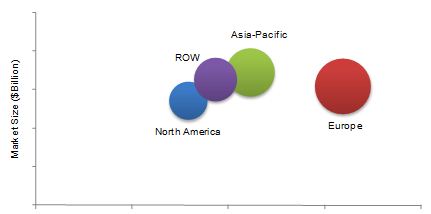

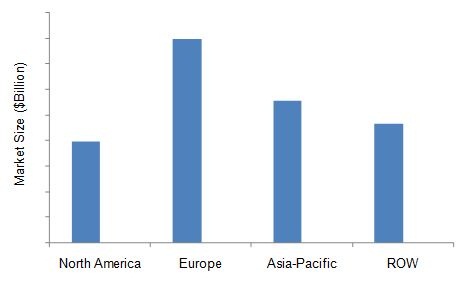

Cosmetic Products Market Size, by Geography, 2013-2019 ($Billion)

P - Projected

Source: MarketsandMarkets Assay

See how this study impacted revenues for other players in Cosmetic Products Market place

Customer�s Problem Argument

Our client, an Italian cosmetics manufacturer, was smashing to increase its market penetration in Iran�s professional hair care market. The customer needed to accept a host of crucial decisions � which production to focus on, which certification to prioritize, and what offer/value proposition to build for target customers in Iran.

MnM Approach

MnM assisted the client by profiling it and ranking information technology on a global footing to ascertain how strong information technology is in its product segment. This was used by the company while applying to the Iran government for admission to enter the marketplace.

Revenue Touch (RI)

Our findings helped the client to penetrate the USD one billion market, with projected acquirement of USD 20 million in 5 years. The client was able to found and grow its professional pilus care segment in the Iran cosmetics market place.

Consult our Annotator now

In 2013, the corrective products market place was dominated past Europe, with Germany as the leading state. The Asia-Pacific region is projected to grow at the fastest charge per unit for the forecast period. The marketplace in the Asia-Pacific region is growing owing to the economic growth, new technological advancements, and changes in style trends.

Get online access to the written report on the World's Commencement Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Visitor Analysis Dashboard for high growth potential opportunities

- Inquiry Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Asking Sample

Scope of the Written report

This report focuses on the corrective products market for the cosmetics industry. The market place was segmented on the footing of type, distribution channel, and geography.

- On the ground of type

- Skin care products

- Colour cosmetics

- Pilus intendance products

- Fragrance and deodorants

- Sun care products

- Soaps, bath, & shower products

- Oral hygiene products

- Personal hygiene products

- Others (baby care, depilatory products, etc.)

- On the footing of distribution aqueduct

- Supermarkets

- Pharmacy & drug stores

- Department stores

- Straight selling

- Specialty stores

- Dazzler salons

- Cyberspace retailing

- Others (shopping club, retail shops, etc.)

- On the basis of geography

- North America

- Europe

- Asia-Pacific

- Residuum of the Globe (ROW)

The cosmetic products marketplace has witnessed a meaning growth in the last few years. The market is driven by the economic development in emerging markets such equally Mainland china, Brazil, among others. Corrective products have become essential in everyday life. These cosmetic products are labeled and manufactured keeping in mind the regulations specified by government bodies to guarantee product prophylactic.

The leading market players including Avon Products, Inc. (U.South.), TheEst�east Lauder Companies, Inc. (U.Southward.), L�Oreal Group (France), among others, prefer evolution strategies such as new production launches and mergers & acquisitions to increment their global presence and enhance their production portfolio. The leading players offer corrective products on the footing of changing fashion trends, upgrading innovations, and customer preferences. Leading cosmetic products manufacturers emphasize on the advancement, multi-functionality, safety, and other desired backdrop of the products.

The corrective products market place is segmented on the basis of blazon, distribution channel, and geography. On the basis of type, it includes skin care products, pilus intendance products, fragrances & deodorants, color cosmetics, personal hygiene products, oral hygiene products, bathroom & shower products, soaps, sun intendance products, and others. The market segmentation on the ground of distribution channel includes supermarkets, department stores, specialty stores, beauty salons, pharmacy & drug stores, Internet retailing, and others. The geographic sectionalisation of the market includes Northward America, Asia-Pacific, Europe, and Residuum of the World (ROW).

Cosmetic Products Market Size, by Geography, 2013 ($Billion)

Source: MarketsandMarkets Analysis

The cosmetic products market place is projected to grow at a CAGR of 6.3% with Europe as the largest market. Information technology is expected to grow at a college footstep with increase in the dispensable income of consumers in emerging markets. The Asia-Pacific region is projected to exist the fastest growing market due to the increasing demand for colour cosmetics, peel intendance, and hair care products hither.

Table Of Contents

ane Introduction (Page No. - nineteen)

ane.1 Cardinal Take-Aways

1.2 Written report Description

1.3 Markets Covered

ane.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Size Estimation

ane.five.1.1 Market Crackdown & Data Triangulation

1.v.1.2 Bifurcation of The Years Considered For Nutrient Diagnostics Market place

1.5.1.iii Assumptions Made For Cosmetic Products Marketplace

1.v.1.4 Key Data Points Taken From Secondary Sources

one.5.1.five Key Data Points Taken From Primary Sources

2 Executive Summary (Page No. - 33)

3 Premium Insights (Page No. - 35)

4 Manufacture Analysis (Page No. - 42)

iv.ane Introduction

4.1.1 History of Cosmetics

4.two Supply Concatenation Analysis

4.3 Market Trends

iv.3.ane Mineral-Enriched Skin Care Cosmetic Products Are in Demand

4.3.ii Fashion Trends Drive The Color Cosmetics Market place Growth

four.3.3 Fragrance

4.3.iv Varieties of Hair Intendance Product Categories

4.3.five Nail Intendance

4.3.6 Natural & Green-Labeled Cosmetics A Potential Segment in The Market

4.four Market Share Analysis

5 Market Overview (Page No. - 47)

5.1 Introduction

5.two History & Evolution

five.3 Related Markets

5.3.1 Specialty Chemicals Industry

six Market Analysis (Page No. - 51)

6.i Introduction

vi.2 Winning Imperatives

6.2.1 R&D Initiatives & Innovations Enables Company to Maintain Global Competitiveness

6.2.2 Companies Use Direct Selling Approach to Increase Their Penetration in The Remote Regions

6.3 Burning Issue

6.3.1 Counterfeit Goods

six.4 Touch Analysis

six.4.1 Drivers

six.4.1.1 Increase of Crumbling Population

6.4.1.2 Change in The Consumer Standard of Living Due to Strengthening of Economy & Globalization

6.iv.i.3 'on-The-Go' Lifestyle of Consumers

6.4.1.4 Cosmetic Packaging Solutions That Result in Piece of cake Application

6.4.ane.5 Smaller Pack Sizes in The Marketplace Helps to Increase The Cosmetic Consumption Volume

half-dozen.4.2 Restraints

6.4.2.one Advanced Medical Technology Assist in Consumer Dazzler Treatment

half dozen.four.2.2 Restricted Application of A Few Ingredients in Cosmetic Product

six.4.3 Opportunities

6.iv.3.ane New Cosmetic Production Development

6.4.three.2 Potential Emerging Market For Corrective Producs

6.4.3.3 Collaboration of Leading Cosmetic Players With Cosmetic Healthcare Sector

six.5 Porter�south Five Forces Analysis

6.5.ane Degree of Competition

6.5.2 Bargaining Power of Suppliers

six.5.iii Bargaining Power of Buyers

6.5.iv Threat of Substitutes

6.5.5 Threat of New Entrants

7 Corrective Products Market place, By Blazon (Folio No. - seventy)

7.1 Introduction

vii.2 Skin Care Products

7.three Hair Care Products

seven.4 Fragrances & Deodorants

7.five Personal Hygiene Products

7.half dozen Color Cosmetic Production:

seven.seven Oral Hygiene Products

7.8 Soap, Bath & Shower Products

7.9 Sun Care Products

7.10 Other Cosmetic Product

eight Cosmetic Product Market, Past Distribution Aqueduct (Page No. - 83)

8.1 Introduction

8.2 Supermarkets

eight.three Chemist's shop & Drug Stores

eight.4 Department Stores

8.5 Direct Selling

viii.half dozen Specialty Stores

viii.7 Beauty Salons

eight.viii Internet Retailing

8.nine Other Distribution Channels

viii.10 North America

8.x.i U.South.

8.10.2 Canada

8.10.3 Mexico

viii.11 Europe

8.11.one U.Yard.

viii.11.ii Italian republic

8.11.iii Germany

viii.xi.4 Spain

8.xi.5 France

8.11.6 Russia

eight.11.7 Other European Countries

eight.12 Asia-Pacific

viii.12.1 People's republic of china

eight.12.2 Japan

8.12.3 Bharat

8.12.4 Korea

8.12.five Taiwan

8.12.vi Australia

eight.12.7 Other Asia-Pacific Countries

viii.13 ROW

8.13.1 Latin America (Except Brazil & Republic of chile)

viii.thirteen.2 Brazil

eight.thirteen.3 Chile

8.13.four The Middle East

8.13.5 Other ROW Countries

ix Cosmetic Products Market, Past Geography (Page No. - 123)

ix.i Introduction

9.2 North America

ix.2.ane U.S.

9.2.ii Canada

9.2.3 United mexican states

ix.3 Europe

nine.3.1 U.G.

9.iii.2 Italy

9.3.three Germany

ix.3.iv Spain

9.3.v France

nine.three.vi Russia

ix.3.7 Other European Countries

9.4 Asia-Pacific

9.four.ane India

9.4.2 Prc

9.four.3 Korea

9.four.iv Taiwan

nine.four.five Japan

9.4.half dozen Australia

9.4.7 Other Asia-Pacific Countries

9.5 ROW

ix.five.1 Latin America

ix.five.ii Brazil

9.5.3 Chile

9.5.4 The Centre Due east

9.5.five Other ROW Countries

ten Competitive Landscape (Page No. - 177)

ten.1 Introduction

10.1.1 Cosmetic Product: Highly Competitive Market

10.ii New Production/Technology Launches-Most Preferred Strategic Approach

10.3 Cardinal Market Strategies

ten.four Mergers & Acquisitions

x.v Agreements, Partnerships & Collaborations

ten.6 New Product/Engineering science Launches

10.7 Expansions and Investments

eleven Company Profiles (Visitor At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)* (Page No. - 187)

11.1 Alticor Inc.

11.ii Avon Products Inc.

xi.3 Kao Corp.

11.4 50'or�al Group

11.5 Mary Kay Inc.

11.6 Oriflame Cosmetics S.A.

11.7 Procter & Gamble Co.

eleven.8 Revlon Inc.

xi.9 Shiseido Co. Ltd.

eleven.x Skinfood

11.11 The Est�e Lauder Companies Inc.

*Details on Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Contempo Developments Might Not Be Captured in Case of Unlisted Companies.

Appendix (Page No. - 245)

Mergers & Acquisitions

New Production/Engineering Launches

Investments & Expansions

Agreements, Partnerships & Collaborations

List of Tables (97 Tables)

Table 1 Corrective Products Marketplace Estimation

Table two Restricted Cosmetic Ingredients Nether Fda Regulation & Their Descriptions

Table 3 Corrective Product Market Size, By Blazon, 2012�2019 ($Billion)

Tabular array 4 Skin Intendance: Products Market Size, By Geography, 2012�2019 ($Billion)

Table v Hair Intendance: Cosmetic Products Market Size, By Geography, 2012�2019 ($Billion)

Tabular array 6 Fragrances & Deodorants: Products Marketplace Size, By Geography, 2012�2019 ($Billion)

Tabular array vii Personal Hygiene: Products Marketplace Size, By Geography, 2012�2019 ($Billion)

Tabular array 8 Color Cosmetics Market Size, By Geography, 2012�2019 ($Billion)

Table nine Oral Hygiene Products: Products Market Size, By Geography, 2012�2019 ($Billion)

Table 10 Soap, Bath & Shower Products: Market Size, By Geography, 2012�2019 ($Billion)

Tabular array 11 Sun Care Products: Market Size, Past Geography, 2012�2019 ($Billion)

Table 12 Others: Cosmetic Products Market Size, By Geography, 2012�2019 ($Billion)

Table thirteen Market Size, By Distribution Aqueduct, 2012�2019 ($Billion)

Table 14 Supermarkets: Marketplace Size, By Geography, 2012-2019 ($Billion)

Tabular array xv Pharmacy & Drug Stores: Products Market Size, By Geography, 2012-2019 ($Billion)

Table 16 Department Stores:Market Size, By Geography, 2012-2019 ($Billion)

Table 17 Direct Selling: Products Marketplace Size, Past Geography, 2012-2019 ($Billion)

Table 18 Specialty Stores: Market Size, By Geography, 2012-2019 ($Billion)

Table 19 Beauty Salons: Products Market Size, By Geography, 2012-2019 ($Billion)

Table 20 Internet Retailing: Cosmetic Products Market Size, Past Geography, 2012-2019 ($Billion)

Tabular array 21 Others: Corrective Product Market Size, Past Geography, 2012-2019 ($Billion)

Tabular array 22 North America: Market Size, By Distribution Channel, 2012�2019 ($Billion)

Tabular array 23 U.S.: Cosmetic Products Market Size, By Distribution Channel, 2012�2019, ($Billion)

Table 24 Canada: Cosmetic Products Market Size, Past Distribution Channel, 2012�2019, ($Billion)

Table 25 Mexico: Cosmetic Products Market place Size, By Distribution Channel, 2012�2019 ($Billion)

Table 26 Europe: Corrective Products Marketplace Size, Past Distribution Channel, 2012�2019 ($Billion)

Tabular array 27 U.Yard.: Cosmetic Products Marketplace Size, Past Distribution Channel, 2012�2019 ($Billion)

Table 28 Italy: Past Market place Size, By Distribution Channel, 2012�2019 ($Billion)

Table 29 Germany: Cosmetic Products Market Size, By Distribution Channel, 2012�2019 ($Billion)

Tabular array 30 Spain: Cosmetic Products Market place Size, By Distribution Channel, 2012�2019 ($Billion)

Table 31 French republic: Cosmetic Products Market Size, By Distribution Channel, 2012�2019, 2012�2019 ($Billion)

Table 32 Russia: Cosmetic Products Market place Size, Past Distribution Channel, 2012�2019 ($Billion)

Table 33 Other European Countries: Market place Size, Past Distribution Channel, 2012�2019 ($Billion)

Table 34 Asia-Pacific: Cosmetic Products Market Size, Past Distribution Channel, 2012�2019 ($Billion)

Table 35 China: Products Marketplace Size, By Distribution Aqueduct, 2012�2019 ($Billion)

Tabular array 36 Japan: Cosmetic Products Market Size, By Distribution Channel, 2012�2019 ($Billion)

Table 37 Bharat: Corrective Products Market Size, Past Distribution Channel, 2012�2019 ($Billion)

Table 38 Korea: Cosmetic Products Market place Size, By Distribution Aqueduct, 2012�2019 ($Billion)

Table 39 Taiwan: Cosmetic Products Market Size, By Distribution Channel, 2012�2019 ($Billion)

Table 40 Commonwealth of australia: Corrective Products Market Size, By Distribution Channel, 2012�2019 ($Billion)

Tabular array 41 Other Asia-Pacific Countries: Cosmetic Products Market Size, By Distribution Aqueduct, 2012�2019 ($Billion)

Table 42 ROW: Corrective Products Market Size, By Distribution Aqueduct, 2012�2019 ($Billion)

Table 43 Latin-America (Except Brazil & Republic of chile): Cosmetic Products Market Size, By Distribution Channel, 2012�2019 ($Billion)

Table 44 Brazil: Cosmetic Products Market Size, By Distribution Channel ($Billion)

Tabular array 45 Chile: Cosmetic Products Market Size, Past Distribution Aqueduct ($Billion)

Table 46 The Middle East: Market Size, By Distribution Channel ($Billion)

Tabular array 47 Other ROW Countries: Marketplace Size, By Distribution Channel ($Billion)

Table 48 Cosmetic Products Market place Size, Past Geography, 2012�2019 ($Billion)

Table 49 North America: Market Size, By Country, 2012-2019 ($Billion)

Table 50 Due north America: Marketplace Size, Past Type, 2012-2019 ($Billion)

Tabular array 51 U.S.: Corrective Products Market Size, Past Blazon, 2012-2019 ($Billion)

Table 52 Canada: Cosmetic Products Market Size, By Type, 2012-2019 ($Billion)

Table 53 Mexico: Cosmetic Products Market Size, Past Type, 2012-2019 ($Billion)

Tabular array 54 Europe: Corrective Products Market Size, By Land, 2012-2019 ($Billion)

Tabular array 55 Europe: Cosmetic Products Market Size, By Type, 2012-2019 ($Billion)

Tabular array 56 U.K.: Market Size, By Type, 2012-2019 ($Billion)

Table 57 Italy: Market Size, Past Blazon, 2012-2019 ($Billion)

Table 58 Germany: Market Size, By Type, 2012-2019 ($Billion)

Table 59 Espana: Corrective Products Market Size, By Type, 2012-2019 ($Billion)

Tabular array 60 French republic: Past Market place Size, Past Type, 2012-2019 ($Billion)

Table 61 Russian federation: By Market Size, By Type, 2012-2019 ($Billion)

Table 62 Other European Countries: Market Size, By Type, 2012-2019 ($Billion)

Table 63 Asia-Pacific: By Market Size, Past Country, 2012-2019 ($Billion)

Table 64 Asia-Pacific: By Market Size, By Type, 2012�2019 ($Billion)

Table 65 India: Market place Size, By Type, 2012�2019 ($Billion)

Table 66 Cathay: Cosmetic Products Market Size, Past Type, 2012�2019 ($Billion)

Tabular array 67 Korea: Market Size, By Type, 2012- 2019 ($Billion)

Table 68 Taiwan: Market Size, By Type, 2012-2019 ($Billion)

Table 69 Japan: Market Size, By Type, 2012�2019 ($Billion)

Table 70 Australia: Cosmetic Products Market Size, By Type, 2012�2019 ($Billion)

Table 71 Other Asia-Pacific Countries: Market place Size, By Type, 2012-2019 ($Billion)

Tabular array 72 ROW: Market Size, Past Region/State, 2012-2019 ($Billion)

Tabular array 73 ROW: Cosmetic Product Market place Size, By Type, 2012-2019 ($Billion)

Table 74 Latin America (Except Brazil & Chile): Cosmetic Products Market Size, Past Type, 2012�2019 ($Billion)

Table 75 Brazil: Marketplace Size By Blazon, 2012-2019 ($Billion)

Tabular array 76 Chile: Market Size By Type, 2012-2019 ($Billion)

Table 77 The Center E: Market Size, By Blazon, 2012�2019 ($Billion)

Table 78 Other ROW Countries: Marketplace Size, Past Type, 2012-2019 ($Billion)

Tabular array 79 Mergers & Acquisitions, 2010�2013

Table fourscore Agreements, Partnerships & Collaborations, 2011�2014

Table 81 New Product/Technology Launches, 2010-2013

Table 82 Expansions and Investments, 2011�2013

Table 83 Amway: Products & Their Description

Table 84 Avon: Products & Their Description

Tabular array 85 Kao: Corrective Products & Their Description

Table 86 L�oreal: Products & Their Description

Table 87 Mary Kay: Products & Their Description

Table 88 Oriflame: Products & Their Description

Table 89 Procter & Gamble: Products & Their Description

Table xc Revlon: Products & Their Description

Table 91 Shiseido: Products & Their Brands

Table 92 Skinfood: Products & Their Clarification

Table 93 Est�eastward Lauder: Cosmetic Products & Their Description

Table 94 Mergers & Acquisitions, 2009-2013

Tabular array 95 New Product/Engineering science Launches, 2009-2013

Table 96 Investments & Expansions, 2009-2014

Table 97 Agreements, Partnerships & Collaborations, 2009-2014

List of Figures (33 Figures)

Effigy i Research Methodology

Figure two Cosmetics Products: Market place Size Interpretation Methodology

Figure iii Information Triangulation Methodology

Figure 4 Cosmetic Products Market Share (Value), By Geography, 2013

Figure v Market Sectionalization

Effigy 6 Market Size, Past Geography,2013 Vs. 2019 ($Billion)

Figure vii Market Size, By Distribution Channel, 2013 Vs. 2019 ($Billion)

Effigy eight Corrective Products Market place Size, By Type, 2013

Effigy 9 Cosmetic Products Market Life Cycle, By Geography, 2013 Vs. 2019

Effigy x Cosmetic Products Dynamics: Drivers, Restraints, Opportunities, & Trends

Figure xi Market Evolution, By Company & Strategy, 2009�2014

Figure 12 Cosmetic Products Supply Chain Analysis

Figure 13 Market Share Analysis, By Company, 2013

Figure fourteen Timeline For Evolution of Cosmetics

Figure 15 Specialty Chemicals Market, 2012

Figure xvi R&D Trends in The Cosmetics Market

Figure 17 Direct Sales Approach

Figure 18 Cosmetic Market place Impact Analysis

Figure 19 Cosmetic Consumption Share, By Age Group, 2012

Figure 20 Cosmetics Market Porter�s Five Forces Analysis

Figure 21 Due north America: Oral Hygiene Products Market, By Product Type, ($Billion), 2013

Figure 22 Corrective Products Market Share, By Distribution Channel, (Value), 2013

Figure 23 Traditional Distribution Channel

Figure 24 International Distribution Channel For Cosmetics

Figure 25 Canadian Market Share (Value), 2013

Figure 26 European Market Share (Value), By Country, 2013

Effigy 27 The U.K. Cosmetic Product Export, 2013

Figure 28 Italian Cosmetic Products Marketplace Size, By Type, 2013-2019 ($Billion)

Figure 29 Cosmetic Imports to Russia, 2011

Figure 30 Market Developments, 2009-2014

Figure 31 Market place Share, Past Growth Strategy, 2009�2014

Figure 32 Cosmetic Products Market Developments, By Growth Strategy, 2009�2014

Figure 33 Cosmetic Products Market Development Strategies, Past Visitor, 2009�2014

Request for detailed methodology, assumptions & how numbers were triangulated.

Source: https://www.marketsandmarkets.com/Market-Reports/cosmetic-products-market-240004417.html

Posted by: keithbourfere.blogspot.com

0 Response to "Fallene Ltd What Is Happening With Distribution Of Makeup?"

Post a Comment